Workplace Violent Act

Is Your Client's Company at Risk?

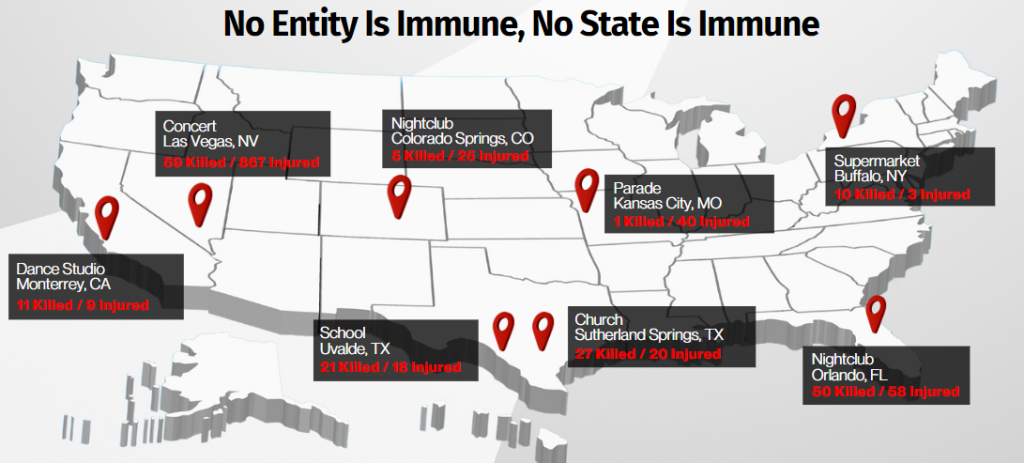

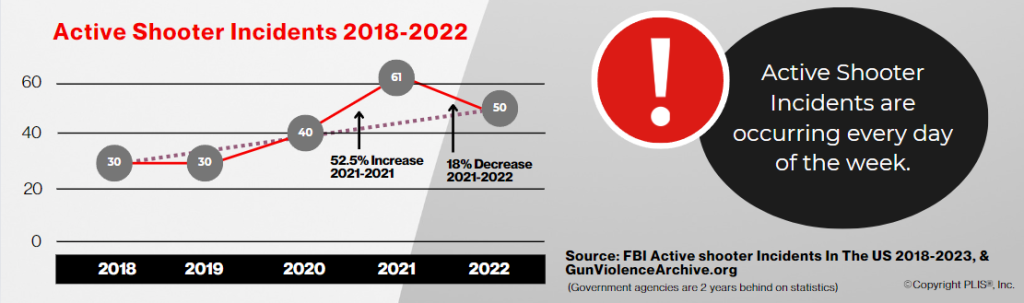

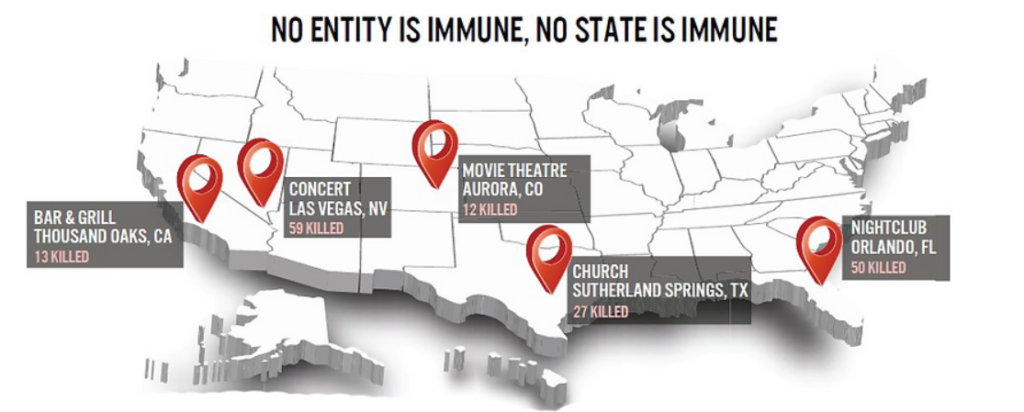

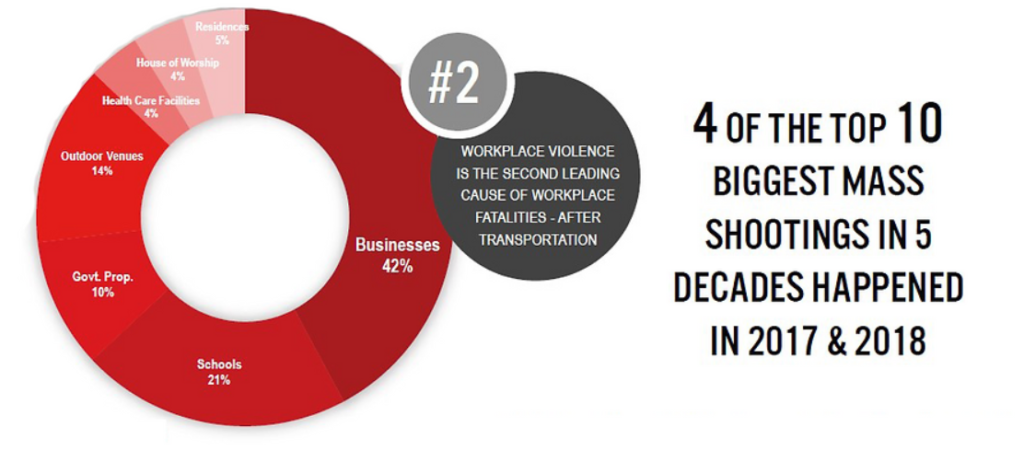

A workplace violence event is the perfect storm for revenue loss & liability. All businesses are vulnerable to this exposure, whether it is a casual office setting or an establishment with late hours and frequent customers. Statistical information and recent headlines today show that these unfortunate events are increasing. Injury is an obvious potential loss, but residual community concerns may impact revenue and future growth.

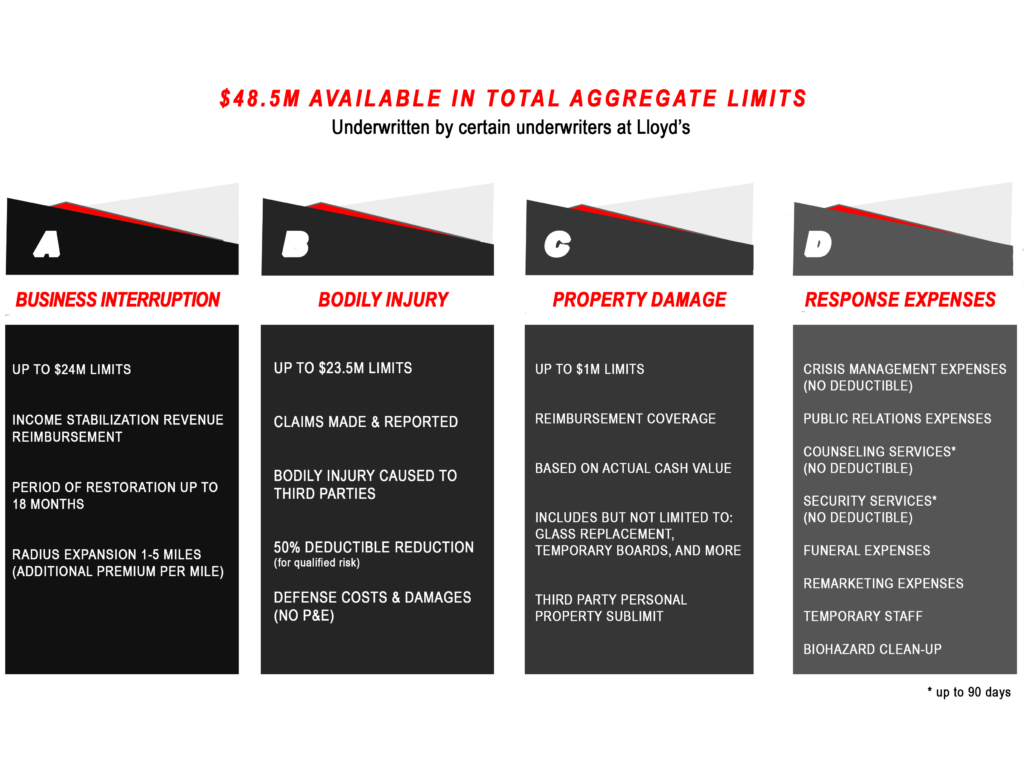

First and Third Party Coverage in One Policy

Up To $48,500,000

Total Aggregate Limits Available

Coverage provided by certain underwriters at Lloyd's

What is Workplace Violent Act (WVA)?

WVA is a multifaceted stand-alone active shooter and violent act coverage created to respond to violent act events, violent act threat events, off-site employee violent events as well as stalking. The policy provides a Period of Restoration up to 18 months for a covered event and provides both first and third-party coverages that include: business interruption, incident response expenses, third party bodily injury liability, and property damage.

Weapons include any firearm, vehicle device, instrument, material or substance.

Insureds have Exclusive Access To Crisis Consultants through

Specialty Risk Management, Inc. (SRM ).

SRM's Team is available 24/7 - 365 Days before, during, and after a violent attack/act.

Separately, altering or influencing outcomes is everyone’s top priority. SRM works with the Insured to develop intervention strategies. Call SRM at the first sign of bullying, stalking, or any other potential violent act.

Crisis Management Includes:

1) Preparation – Every business starts with a basic plan for security and training.

2) Awareness – Assistance with intervention strategies for evolving or high risk situations.

3) Response – Essential crisis management response at the time of an event including media statements, customer/employee assistance, government agency coordination, and more. SRM is available 24/7/365 for immediate crisis response.

4) Recovery – SRM assists with the recovery of the brand name.

© Copyright SRM® , Inc. and its licensors. All Rights Reserved.

This page is not intended to be a representation of coverage. See policy wording for details. All coverage

features are still subject to individual underwriting and certain coverage features may be restricted.

Powered by

Powered by